2025–2027 Medium-Term Management Plan

Purpose

Establishment of Purpose

In 2022, we redefined the significance of existence of PILOT and established our Purpose as our steadfast management objective.

Keeping in mind the idea reflected in this Purpose, we will move forward with initiatives to achieve sustainable growth of the Group and address social issues, thus contributing to building a sustainable society.

Purpose of PILOT Group

2030 Vision

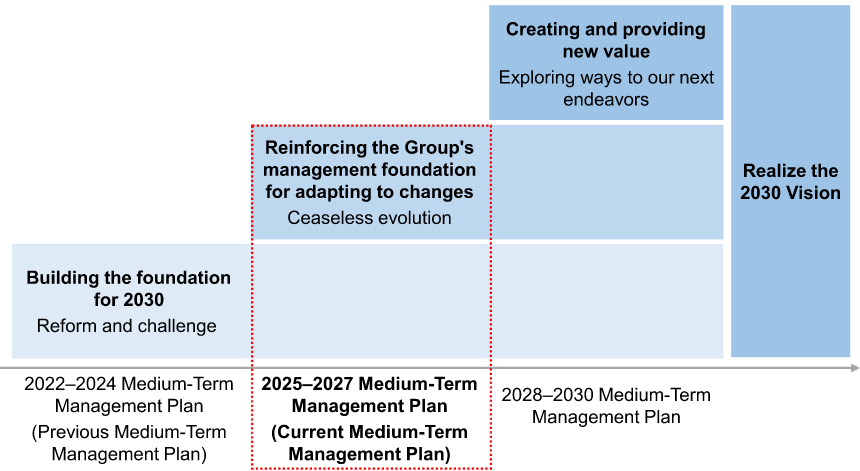

The 2030 Vision, which we presented when we announced our 2022–2024 Medium-Term Management Plan (hereafter, the "previous Medium-Term Management Plan") remains unchanged.

In the coming 100 years, we will continue to support the act of writing of people around the world with our writing instruments. We will also leverage our technologies derived from writing, which have been cultivated over the past 100 years, to respond to major changes in the external environment, with a commitment to supporting society, and culture in fields other than writing instruments as well.

Establishment of the 2030 Vision

In March 2022, we established our 2030 Vision to determine our group's long-term direction by backcasting from what we want to achieve in the future based on our Purpose "Our Creations Inspire Creativity."

2030 Vision of PILOT Group

We support the act of writing around the world and at the same time

support society and culture in fields other than writing.

No. 1 brand in the global writing instrument market—Expansion of overseas business, maintain share of domestic market

Grow with non-writing instrument businesses as the second pillar—Sales composition ratio 25%

Offer value to the environment, society, and employees—Contribution to the creation of a sustainable earth and society

In the stationery business, we will establish a solid position as the No.1 brand in the global writing instruments market by maintaining our market share in Japan while achieving further business expansion in overseas markets. Further, we will create and develop new businesses in addition to existing toys and industrial materials businesses, aiming to increase the ratio of sales of the non-writing instrument business to 25% by 2030 and to be a corporate entity that can provide value to people all over the world in various stages of their life. At the same time, toward 2030, we will contribute to and provide value to the global environment and local communities and build a workplace environment which permits our employees to work with good physical and mental health.

Medium-Term Management Plan

2025–2027 Medium-Term Management Plan: Summary

Under the current Medium-Term Management Plan, we will continue with our basic strategies and narrow down management tasks for achieving the 2030 Vision. To achieve growth in the writing instrument business in the global market, we will deliver attractive tools and opportunities that support the value of writing and the act of writing to people all over the world, thereby maintaining and improving our margin.

We will promote management that is conscious of cost of capital and stock price, and strengthen shareholder returns.

Positioning

Under the current Medium-Term Management Plan, we will strengthen the overseas expansion of the writing instrument business, which is our core business, and create new businesses. We position this as a phase for reinforcing the Group's management foundation for adapting to changes, as we achieve ceaseless evolution, towards attaining the 2030 Vision.

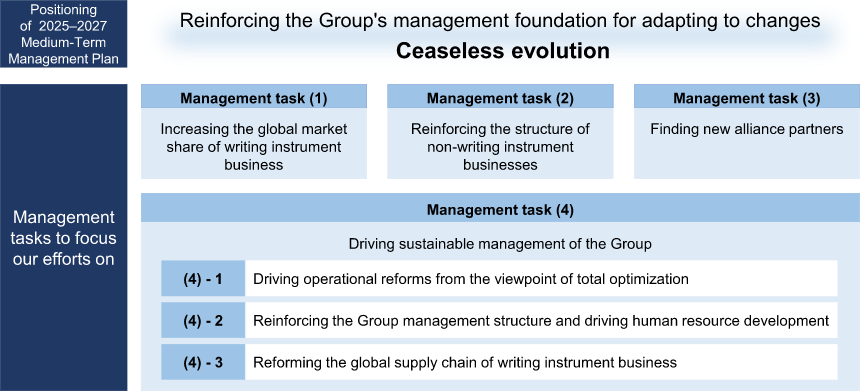

Management Tasks to Focus Our Efforts on

We understand that achieving growth in the writing instrument business in the global market is the top-priority management task that we should be focused on, as we seek to attain the 2030 Vision. We will also reinforce the structure of non-writing instrument businesses to create new businesses. Judging that finding new alliance partners and driving sustainable management of the Group is important for implementing the above tasks, we will commit ourselves to them under the current Medium-Term Management Plan.

Financial Targets

To be the No. 1 brand in the global writing instrument market, we will strive to increase sales by 4% to 5% every fiscal year. On the other hand, the operating margin will be stagnant due to an increase in depreciation associated with investment in growth and rising material costs. By implementing cost controls, we aim to achieve an operating margin of 16% or higher in FY2027.

Because we will also improve our return on capital and increase shareholder returns, we have set target consolidated net sales, operating margin, ROE, and the total payout ratio as our financial targets.

(Exchange rate assumed for FY2025 and onward: 1 US dollar = 150 yen, 1 euro = 160 yen, 1 yuan = 21.4 yen)

Management that is conscious of Cost of Capital and Stock Price

PBR has remained between 1.2 and 1.4 since January 2024, and we believe that we are receiving a certain level of valuation. Through dialogue with investors, we understand that we should maintain and improve the margin ratio even in a difficult earnings environment and operate efficiently without waste. We have therefore set operating margin and ROE as our financial targets again.

We recognize our company's cost of equity to be 6.5-7.5%. We will move ahead with initiatives to widen the spread between it and ROE, including cost control and capital efficiency improvement.

| Recognition

|

- Under the previous Medium-Term Management Plan, we worked to build the foundation

for 2030 Vision and reaffirmed the importance of developing management foundation

further.

- We recognize our company's cost of equity to be 6.5-7.5%.

- ROE remained above the cost of equity throughout the period of the previous Medium-Term Management Plan (11.2% in FY2024).

- PBR has remained relatively high at 1.2 to 1.4 since January 2024.

- Regarding the balance sheet, the level of cash and deposits has been higher, and the

inventory turnover period has been longer, compared to the 2010s.

- The earnings environment will remain challenging for the time being, with factors

including rising labor costs for securing human resources globally, capital expenditure

that has remained at a high level, and sluggish consumption demand in overseas

markets.

|

| Policies

|

- To enhance shareholder returns, we have set a new target of the total payout ratio of 50%

or higher.

- We will acquire treasury shares flexibly in response to changes in the business

environment, for the purpose of improving capital efficiency.

- We will review the balance sheet with a focus on cash and deposits and inventories.

|

| Initiatives

|

- We have set the targets for the FY2027, the final fiscal year of the current Medium-Term

Management Plan as consolidated net sales of 145 billion yen, an operating margin of

16% or higher, and an ROE of 11% or higher.

- We will continue cost control by focusing on our priority measures and aim to reduce

SG&A ratio below 35% in FY2027.

- We recognize that the appropriate level of cash and deposits is around 30 billion yen, and

we will actively invest our surplus funds in the future.

- With regard to inventories (stock), we will strive to lower the inventory levels through

supply chain reforms, by assuming levels before the COVID-19 pandemic (2019).

|

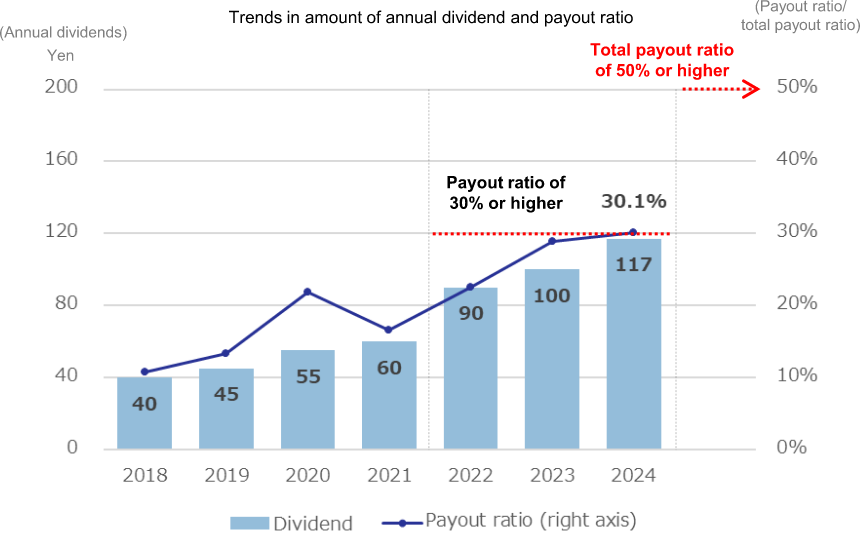

Strengthening Shareholder Returns

Under the previous Medium-Term Management Plan, we set a payout ratio at 30% or higher as one of our financial targets. Under the current Medium-Term Management Plan, we will strengthen shareholder returns by targeting a total payout ratio of 50% or higher while maintaining the principle of paying stable dividends.

We will also acquire treasury shares flexibly in response to changes in the business environment, for the purpose of improving capital efficiency and increasing shareholder returns.

Cash Allocation

At the Board of Directors meeting held on August 7, 2025, it resolved to revise part of the cash allocation in the 2025–2027 Medium-Term Management Plan as follows:

- In consideration of current equity ratio, we will increase the planned shareholder return from 22,000 million yen to 40,000 million yen to enhance shareholder return by taking following actions:

- (1) We continue to acquire treasury shares in the next fiscal year and beyond.

- (2) For the shareholder return policy, we have introduced a “progressive dividend" in addition to our target "total payout ratio of 50% or more."

- We actively utilize external funds while ensuring financial soundness.

Sustainability Initiatives

Based on the 2030 Vision, the Group will achieve sustainable growth and create an environment which permits people to live life to the fullest and demonstrate their creativity, through its business activities.

At the same time, we will address social issues and help build a sustainable society.

Past Medium-Term Management Plans